In 304 BC The Battle of the Granicus River took place, shaping world finance for the next 2,300 years. The battle took place at the crossing of a river in what is now north eastern turkey.

Alexander the Great was marching to conquer Persia. The tale was of Biblical proportions, prophesied by Daniel near 600 BC. The fight against Persia gave humanity some of the greatest battles recorded in history and the greatest acts of valor. Many of these, such as the Spartans fight against the Persians in, The Battle of Thermopylae, are captured in film i.e. the movie 300.

The Persian empire had been growing for 200 years and seemed unstoppable. In 546 BC, Persia captured the Kingdom of Lydia. Lydia was no ordinary kingdom. It told of legend and riches. Lydia had invented something no other country had done – coinage. The metal that formed their coins was made of electrus, a gold/silver alloy found in the river Pactolus. This was the same river that King Midas washed off the “Gold Touch”. The legend says the river had sand of gold and was rich from the touch washing off.

Despite the myth, the truth is that this new invention changed the world. The Persians held this now province for the next 242 years. Over that time period, the new coins then spread into Persia with Cyrus the Great striking the first coin in Babylon.

However, it wasn’t until Alexander the Great gained sovereignty over Lydia in 304 BC did this invention spread to the west. The benefit of the ability to exchange goods and services through a stable precious metal medium became immediately obvious to the Greeks and coinage took off. From the coin archeology records we hold, coinage and bullion evolved from this point to form stable economies for the world’s greatest civilizations. Since this meeting, the greatest civilizations have relied on gold and precious metals to maintain a stable money system. Well, except until recently.

Since 1970, the United States (the worlds’ superpower at that point) has separated itself from the gold standard and entered into a FIAT currency whereby the government’s word gives credence to the value of the money as well as popular sentiment.

The government now controls the money supply and now is able to create money at will. This happens through controlling interest rates of the bond markets as well as purchasing securities and other assets. By manipulating the market through these tools, they can change the financial landscape.

When markets are manipulated and money values changed, there are consequences. When the Fed buys bonds or assets, the money supply is increased, driving inflation. This also drives asset prices higher as pension funds can reallocate to risker markets. It also can increase the wage gap through stifling lower class wages yet the wealthy’s debt is whipped out by inflation. Furthermore, the country’s economy can only hold up to so much debt. Those bonds need to be paid back someday.

The story of the birth of currency drives a powerful moral. King Midas was gifted the power of turning everything to gold. Each item he touched increased the total gold in the region. Because money and gold were linked, more gold meant more money. So as he touched more items he increased the money supply. As one can see, this would be very advantageous to Midas. He would grow very wealthy as he could generate money on demand. However, as he created more gold the overall value of gold would decrease in the region. Midas didn’t care as he had an infinite supply and could afford any luxury. However, those who lived in the land would have found their gold bought less and less.

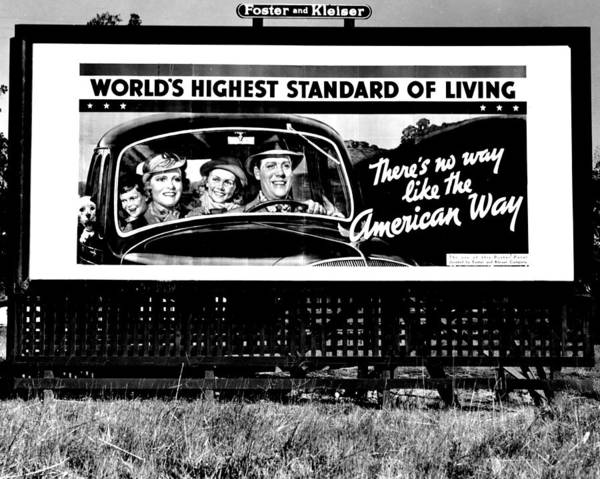

We have seen this globally for decades. The US dollar is the global currency that a majority of the world uses to trade. The United States, just like King Midas, has been generating money for these past years which has allowed us to buy our wealth through money printing. However, foreign countries aren’t able to create dollars so they have a fixed supply of this money. Over the past few decades they have been able to buy less and less of our goods while at the same time this is why the US has seen such an apparent increase in income and standard of living. The rest of the world ends up propping up the standard of living up in the west.

The dark side of this is the continual inflation since the 1970s and its effect on the lower class. Due to the rising cost of rent, goods, and services and the stagnating wages from inflation, it has continuously become more difficult to live with a low wage. This has increased the wage gap considerably and caused tension throughout the US and driven many to think capitalism is to blame rather than the Federal Reserve. Furthermore, we have a large trade deficient as the US has become fat, lazy, and luxurious, as we have feasted on ill-gotten gain rather than worked for our wealth.

King Midas was enamored by his wealth until reality set in. What started out to seem like a tremendous blessing turned into tragedy when the King tried to eat food but the food turned to gold. As he become thirsty he drank but his water turned solid. Hungry and parched, the story comes to a climax, he hugged his daughter Marigold for comfort and even she turned to gold. Like so often, great power turned into a curse. He sought the gods to reverse the blessing and they provided. They said, all he needed to do was to wash his hands in the river Pactolus and the gold touch would be washed away. When he returned home, his daughter and all his items returned back to normal. Gone was the tremendous riches. Real wealth is created through providing value and efficiency.

Will our Federal Reserve wash their Midas touch off or will it take a tragedy to let the market be free with a stable monetary system?